The S&P 500 (SNPINDEX: ^GSPC) is widely regarded as the best barometer for the overall U.S. stock market due to its scope and diversity. The index tracks 500 large American companies spanning all 11 market sectors, covering about 80% of domestic equities by market capitalization.

Since Joe Biden was inaugurated as the 46th U.S. president on January 20, 2021, the S&P 500 has returned 43%, or 11% annually. With the next presidential election just months away, investors may be curious about how the stock market has performed under other Democratic and Republican presidents.

The average stock market return under Democratic and Republican presidents

The S&P 500 was created in March 1957. Since its inception, the index has returned 12,510% excluding dividend payments, which is equivalent to a compound annual growth rate (CAGR) of 7.4%. That does not mean the S&P 500 has increased by 7.4% every year, but rather that it has returned an average of 7.4% annually since 1957.

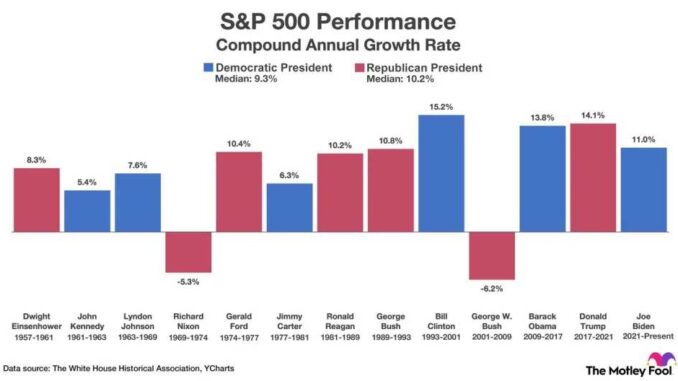

The graphic below shows the S&P 500’s CAGR during each presidency. It also shows the median CAGR under individual Democratic and Republican presidents. Dividend payments are excluded.

Understanding these trends can provide valuable insights for investors looking to make informed decisions based on historical data. As the next election approaches, these statistics may help to contextualize potential market movements and economic policies under different administrations.

Since 1957, the S&P 500 has achieved a median compound annual growth rate (CAGR) of 9.3% under Democratic presidents and 10.2% under Republican presidents. At first glance, it might seem logical to conclude that the stock market performs better when Republicans control the White House.

Not so fast! Statistics can be misleading if not examined closely. Let’s consider the question from another perspective. The graphic below shows the S&P 500’s return in each individual year since 1957, alongside the median one-year return under both Democratic and Republican presidents. Dividend payments are excluded from these calculations.

By analyzing these annual returns, we can gain a clearer understanding of how the stock market responds to the leadership of different political parties. This approach helps to paint a more accurate picture of market performance and avoids the pitfalls of overly simplistic conclusions.

So, before you make any assumptions about which party is better for your investments, take a look at the detailed breakdown and discover the nuances that the raw numbers might hide.

Since 1957, the S&P 500 has achieved a median one-year return of 12.9% under Democratic presidents and a median one-year return of 9.9% under Republican presidents. Based on that information, it would be logical to conclude that the stock market has performed better when Democrats control the White House.

So, which political party is best for the stock market? It depends on how the data is analyzed. The S&P 500 has seen both good years and bad years under Democrats and Republicans. However, the question itself is ultimately irrelevant for two reasons. First, macroeconomic fundamentals, not political parties, control the stock market. While presidential policies and congressional legislation can significantly impact the economy, no single person or political party ever has complete control.

Secondly, market performance is influenced by a multitude of factors, including global economic conditions, technological advancements, and investor sentiment. Therefore, attributing stock market success or failure solely to the political party in power oversimplifies the complex nature of market dynamics.

In summary, while historical data may suggest a trend favoring Democratic presidents in terms of stock market returns, it’s crucial to recognize the broader economic forces at play. Investors should focus on macroeconomic fundamentals and long-term strategies rather than political affiliations when making investment decisions.

Leave a Reply